Quick Start

This page is an introductory tutorial for people who are new to using TataruBook. This tutorial shows you how to use TataruBook’s common features from start to finish, through a series of use cases.

Initialize the DB file

First, download and install TataruBook, if you don’t know how, see here. This article assumes that you have installed TataruBook on your Windows system as an executable file.

Once the installation is complete, open File Explorer, right-click on the background of a folder’s content and select TataruBook create DB file (note that Windows 11 hides some of the context menu items by default, you need to specify that all menu items be shown first). A window will appear asking for a DB file name:

Input DB filename to create with(for example: financial.db):

You can enter any filename you like, but the filename must end in .db. In this example, we type accounting.db and enter, then the accounting.db file will appear in the folder, which is the DB file that holds the bookkeeping data.

There is another way to create a DB file: open the command line terminal of your operating system, switch to the directory where the TataruBook program is located, and execute the command:

tatarubook init accounting.db

This operation also creates the accounting.db file. In fact, when using TataruBook’s context menu command, TataruBook automatically converts the context menu command to the corresponding command-line for execution. Therefore, each context menu operation and the corresponding command-line operation are equivalent.

Next, in order to do bookkeeping, you need to add a currency type first. Adding a currency type requires modifying the asset_types table. In order to modify the table contents, you need to know what fields the table includes first. We recommend exporting this table using the export command before modifying it.

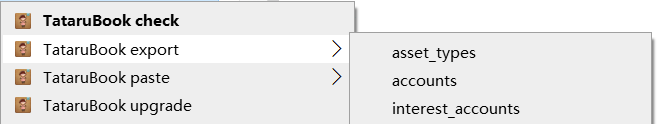

Right-click on the accounting.db file you just created and select asset_types under the TataruBook export table submenu:

The text in the pop-up window will indicate that the asset_types.csv file was created. Close the pop-up window and open the asset_types.csv file using Excel and you will see an empty table containing only the headers:

| asset_index | asset_name | asset_order |

|---|---|---|

You can then add content to the table. The asset_index field is an auto-generated index and this column should be empty. The asset_name field represents the name of the asset (or currency), in this example we put in Gil. The asset_order field represents the order number of the asset to be used for sorting, we don’t care about it for now, let’s just fill in value 0. The contents of the form after filled in are as follows:

| asset_index | asset_name | asset_order |

|---|---|---|

| Gil | 0 |

Many of the examples in the TataruBook documentation are borrowed from the Final Fantasy 14 game setting. In Final Fantasy 14, the primary currency is Gil, so this article uses that currency for its examples. When it comes to actual bookkeeping, you can use any currency name, such as USD, JPY, RMB, etc.

Next, select the contents of the newly added line, copy it to the clipboard by pressing the Ctrl+C key combination, then right-click on the accounting.db file and select asset_types under the TataruBook paste submenu. The newly added row will then be inserted into the asset_types table in the accounting.db file.

In fact, you can copy any row or rows from the table and then use the TataruBook paste command to insert them into the DB file. If the copied content contains a table header, the TataruBook paste command automatically recognizes it and skips the header.

After executing this command, the text in the pop-up window displays some strange messages:

Integrity check after insertion:

start_date should contain exactly 1 row but 0 row(s) are found.

end_date should contain exactly 1 row but 0 row(s) are found.

standard_asset should contain exactly 1 row but 0 row(s) are found.

These are problems reported by TataruBook after performing data consistency check. TataruBook contains a number of views that analyze financials, many of which require specific data to exist in order to perform calculations. Therefore, if TataruBook finds that the required data is missing, it will prompt for it. Often the message text is enough to understand what problem it is reporting.

Let’s solve the problems in the prompt message one by one:

First set the start date and end date of the statistics period to solve the problem of the start_date table and the end_date table each need to have one record in them: type 2022-12-31 wherever you can edit the text and copy it, then right-click on the accounting.db file and select start_date under the TataruBook paste submenu. This sets the start date of the statistics period using the date value in the clipboard. Set the end date of the statistics period to 2023-12-31 in the same way.

Note: The starting point of the statistics period is the end moment of the day of start_date, so if you wish to have statistics for a whole year of 2023, don’t write start_date as 2023-1-1, otherwise the day 2023-1-1 will be missed in the statistics.

The content of the vast majority of views in TataruBook is determined by the statistics period defined by start_date table and end_date table. For example, start_stats view displays the account balances and values at the end of the day start_date; end_stats view shows the account balances and values at the end of the day end_date; the ROI related view shows the returns over the statistics period, and so on. By modifying start_date and end_date, you can modify the statistics period to look at the financials for a specified historical period.

Then set the unique currency Gil as the bookkeeping home currency to solve the problem of needing a record in the standard_asset table: select and copy the cell in previous asset_types.csv table which contains Gil, then right-click on the accounting.db file, select standard_asset under the TataruBook paste submenu. This sets the home currency to Gil.

In the actual data of DB file’s table, assets are referenced using the value of the asset_index field rather than the asset_name field, since the asset_name field is not the primary key of the table, and it is possible that there may be assets with the same name. However, it is not convenient for the user to enter the value of the asset_index field, so TataruBook allows the user to enter the value of the asset_name field where the value of the asset_index field is required, and as long as an asset can be uniquely identified based on the value entered, then TataruBook will automatically convert it internally to the corresponding asset_index field value. For the detail of this function, see here.

Now the data consistency issues are all solved. In the pop-up window of the last TataruBook paste operation, TataruBook reports:

Integrity check after overwrite:

Everything is fine, no integrity breach found.

TataruBook automatically performs a data consistency check after each data modification operation. You can also do it manually at any time: just select TataruBook check in the context menu.

Start bookkeeping

Let’s start by adding a bank account: right-click on the accounting.db file, select accounts under the TataruBook export table submenu, open the resulting accounts.csv file and add one line of content:

| account_index | account_name | asset_index | is_external |

|---|---|---|---|

| Sharlayan Bank current | Gil | 0 |

Then copy this line to the clipboard, right-click on the accounting.db file, and select accounts under the TataruBook paste submenu to complete the insertion of the contents.

The process of inserting content into any table in the DB file is similar, so we will not repeat the insertion process in detail later.

The inserted row indicates that the name of the account is Sharlayan Bank current, the corresponding asset (or currency) is Gil, and the last field has a value of 0 indicating that the account is an internal account.

You may be wondering what is “internal account”? The answer to this question will come soon.

Suppose the balance inside the Sharlayan Bank current account is not \(0\) before we start bookkeeping, and now we want to enter this balance into TataruBook. However, TataruBook uses double-entry bookkeeping. So, to add value to an account, there must be another account that reduces the value by an equal amount. To fulfill this requirement, we add another external account named Opening balance to the accounts table (note that this time the is_external field value is 1):

| account_index | account_name | asset_index | is_external |

|---|---|---|---|

| Opening balance | Gil | 1 |

Note that TataruBook paste performs insert operation rather than synchronization operation. If part of the contents of the table being editing already exist in the DB file, you should copy only those newly added rows and then execute TataruBook paste.

Value can now be transferred from the Opening balance account to the Sharlayan Bank current account. Insert a record to postings table to add a transaction:

| posting_index | trade_date | src_account | src_change | dst_account | comment |

|---|---|---|---|---|---|

| 2022-12-31 | Opening balance | -5000 | Sharlayan Bank current | Brought forward |

After insertion, TataruBook believes that on the day 2022-12-31, the Opening balance account was decreased by \(5000\) Gil and the Sharlayan Bank current account was increased by \(5000\) Gil.

Next we want to record food and beverage spendings by first adding an external account named Food and Beverages to accounts table:

| account_index | account_name | asset_index | is_external |

|---|---|---|---|

| Food and Beverages | Gil | 1 |

Then, add two purchases to postings table:

| posting_index | trade_date | src_account | src_change | dst_account | comment |

|---|---|---|---|---|---|

| 2023-1-5 | Sharlayan Bank current | -20 | Food and Beverages | Breakfast at Inn | |

| 2023-1-7 | Sharlayan Bank current | -45 | Food and Beverages | Dinner at the Last Stand |

After the execution is complete, right-click on the accounting.db file and select statements under the TataruBook export view submenu to export the statements view. Open the statements.csv file that appears in the folder with Excel and you’ll see the following:

| posting_index | trade_date | account_index | amount | target | comment | src_name | asset_index | is_external | target_name | balance |

|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 2022/12/31 | 1 | 5000 | 2 | Brought forward | Sharlayan Bank current | 1 | 0 | Opening balance | 5000 |

| 1 | 2022/12/31 | 2 | -5000 | 1 | Brought forward | Opening balance | 1 | 1 | Sharlayan Bank current | -5000 |

| 2 | 2023/1/5 | 1 | -20 | 3 | Breakfast at Inn | Sharlayan Bank current | 1 | 0 | Food and Beverages | 4980 |

| 2 | 2023/1/5 | 3 | 20 | 1 | Breakfast at Inn | Food and Beverages | 1 | 1 | Sharlayan Bank current | 20 |

| 3 | 2023/1/7 | 1 | -45 | 3 | Dinner at the Last Stand | Sharlayan Bank current | 1 | 0 | Food and Beverages | 4935 |

| 3 | 2023/1/7 | 3 | 45 | 1 | Dinner at the Last Stand | Food and Beverages | 1 | 1 | Sharlayan Bank current | 65 |

This data is similar to the usual transaction ledger statements that we see commonly. Filtering on src_name using Excel gives a different perspective: when filtering on the internal account Sharlayan Bank current, you see a chronological record of transactions and balances for that account; when filtering by the external account Food and Beverages, you see all transactions that occurred in the name of Food and Beverages. So, internal accounts contain assets or liabilities, external accounts are categorization of income and expenses. In TataruBook, you can categorize your income and expenses statistics any way you like: just add the corresponding external accounts.

Categorized statistics

Building on the previous section, let’s move on to importing more bookkeeping data. Start by adding some internal and external accounts to accounts table:

| account_index | account_name | asset_index | is_external |

|---|---|---|---|

| Sharlayan Bank credit card | Gil | 0 | |

| Shopping | Gil | 1 | |

| Rent | Gil | 1 | |

| Salary | Gil | 1 |

Then, add a batch of transaction records to the postings table:

| posting_index | trade_date | src_account | src_change | dst_account | comment |

|---|---|---|---|---|---|

| 2023/2/10 | Salary | -8000 | Sharlayan Bank current | Monthly salary | |

| 2023/2/13 | Sharlayan Bank credit card | -190 | Shopping | Clothes shopping | |

| 2023/2/26 | Sharlayan Bank credit card | -140 | Shopping | Buying Household Items | |

| 2023/3/2 | Sharlayan Bank credit card | -9000 | Rent | Half-yearly rent | |

| 2023/3/10 | Salary | -8000 | Sharlayan Bank current | Monthly salary | |

| 2023/3/10 | Sharlayan Bank credit card | -43 | Food and Beverages | Lunch at the Last Stand | |

| 2023/3/20 | Sharlayan Bank current | -9300 | Sharlayan Bank credit card | Pay off credit card |

In actual bookkeeping, the input data often comes from statements provided by banks, brokerage firms, and other organizations. It is obviously troublesome to manually write each transaction into the format required by the postings table. Therefore, we recommend that you use means such as Excel formulas to automatically convert the raw statement data. The data importing guide describes in detail how to use Excel to automatically import statement data.

TataruBook has a lot of checks on the inserted data, you may encounter a failure of inserting a certain record during batch insertion. In this case, a rollback will be triggered to restore the DB file to the state it was in before the command was executed. You can then correct the errors in the contents of the table and re-execute the command. The automatic rollback feature eliminates the need for users to worry about importing huge amount of records with partially successful inserts that make the state of the DB file difficult to determine.

Now we want to look at the categorized statistics of income and expenses. Exports the income_and_expenses view, you’ll see the following:

| asset_order | account_index | account_name | total_amount | asset_index | asset_name | total_value |

|---|---|---|---|---|---|---|

| 0 | 3 | Food and Beverages | 108.0 | 1 | Gil | 108.0 |

| 0 | 5 | Shopping | 330.0 | 1 | Gil | 330.0 |

| 0 | 6 | Rent | 9000.0 | 1 | Gil | 9000.0 |

| 0 | 7 | Salary | -16,000.0 | 1 | Gil | -16,000.0 |

These data shows the statistics for each type of income and expense during the statistics period. Note: Since the amount changed in the external account is the opposite of the internal account when they are both contained in one transaction, therefore positive numbers in these data indicate expenses and negative numbers indicate income.

The income_and_expenses view shows the sum of the transaction amounts of all the internal accounts on a particular type of income and expense. If you want to see the statistics broken down to each internal account, you can examine the flow_stats view:

| flow_index | flow_name | account_index | account_name | amount |

|---|---|---|---|---|

| 3 | Food and Beverages | 1 | Sharlayan Bank current | 65.0 |

| 3 | Food and Beverages | 4 | Sharlayan Bank credit card | 43.0 |

| 5 | Shopping | 4 | Sharlayan Bank credit card | 330.0 |

| 6 | Rent | 4 | Sharlayan Bank credit card | 9000.0 |

| 7 | Salary | 1 | Sharlayan Bank current | -16000.0 |

In the flow_stats view, you can see how many Food and Beverages have been incurred by each of the Sharlayan Bank current and Sharlayan Bank credit card internal accounts.

If you want to know what the final balance of each internal account is after these transactions, you can examine the end_stats view:

| asset_order | date_val | account_index | account_name | balance | asset_index | asset_name | price | market_value | proportion |

|---|---|---|---|---|---|---|---|---|---|

| 0 | 2023-12-31 | 1 | Sharlayan Bank current | 11635.0 | 1 | Gil | 1.0 | 11635.0 | 1.006 |

| 0 | 2023-12-31 | 4 | Sharlayan Bank credit card | -73.0 | 1 | Gil | 1.0 | -73.0 | -0.006 |

Note that the credit card has a negative balance, this is the norm for most credit card accounts.

TataruBook does not allow account balances to be input directly (the previous operation of entering an opening balance actually enters a transaction), and the balances of all accounts are calculated automatically from the transaction history. During bookkeeping, the data entered can be effectively verified for completeness and accuracy by checking whether the balance displayed by TataruBook and the actual account balance are the same.

Interest earnings

Funds in a bank account often have interest earnings. In order to record the interest, first add the external account that represents the interest to accounts table:

| account_index | account_name | asset_index | is_external |

|---|---|---|---|

| Gil interest | Gil | 1 |

If there are many different currencies in use, you need to set up different external accounts by different currencies. The interest account is named Gil interest for this reason: if other currencies are added later, the external accounts corresponding to the interest in the other currencies can be distinguished from Gil interest. Of course, if you only use one currency, you don’t need to take this into account.

TataruBook can calculate actual interest rate for each account. In order to perform that, interest accounts need to be added to the interest_accounts table:

| interest_accounts |

|---|

| Gil interest |

Now you can add the interest earnings to postings table:

| posting_index | trade_date | src_account | src_change | dst_account | comment |

|---|---|---|---|---|---|

| 2023-3-30 | Gil interest | -30 | Sharlayan Bank current | Interest payment | |

| 2023-6-30 | Gil interest | -35 | Sharlayan Bank current | Interest payment |

The interest_rates view then allows you to view the account’s interest rate calculated with the current data:

| account_index | account_name | asset_index | avg_balance | interest | rate_of_return |

|---|---|---|---|---|---|

| 1 | Sharlayan Bank current | 1 | 11278.38 | 65.0 | 0.00576 |

These figures indicate that the average daily account balance of Sharlayan Bank current during the statistics period was \(11278.38\) Gil, and the interest rate was about \(0.576\%\). For a detailed description on this calculation, see the modified Dietz method.

Checking the interest rate for each account helps to avoid errors in bookkeeping. If the calculated interest rate doesn’t make sense, it’s an indication that there may be an error in the bookkeeping data.

Stock Investments

To record a stock investment, you first need to add an asset representing a particular stock. For TataruBook, stocks and currencies are not fundamentally different; they are both specific assets. Therefore, adding a stock asset to the asset_types table is the same as adding a currency:

| asset_index | asset_name | asset_order |

|---|---|---|

| Garlond Ironworks shares | 1 |

We write the value of the last field asset_order as 1 so that the stock asset will come after the currency asset in views like end_stats. If you don’t care about the order in which the assets are listed in various views, you can set the asset_order to 0 for all assets.

Next add the internal account that holds this stock. tataruBook allows multiple internal accounts to hold the same stock, but we’ll just add one stock account for now to accounts table:

| account_index | account_name | asset_index | is_external |

|---|---|---|---|

| Moogle:Garlond Ironworks shares | Garlond Ironworks shares | 0 |

Stock trading in TataruBook is nothing more than a transfer of assets between internal accounts. But now a problem arises: in every previous transaction, the decrease in the source account (i.e. the transfer out account) is always equal to the increase in the target account (i.e. the transfer in account). So when recording a transaction, we only had to write a single number, and TataruBook would complete the balance change for both the source and target accounts. Now, however, the cash and stock accounts contain different assets: the balance in the cash account is the amount of money, while the balance in the stock account is the amount of shares. So the amount of change in the cash account in a transaction does not equal the opposite of the amount of change in the stock account (unless the share price happens to be \(1\)).

To solve this problem, TataruBook specifies that when two accounts in a transaction record contain different assets, the change amounts for both the source and target accounts must be provided. This is reflected by having an extra number at the end of row to indicate the amount of change in the target account when inserting to postings table:

| posting_index | trade_date | src_account | src_change | dst_account | comment | |

|---|---|---|---|---|---|---|

| 2023-7-3 | Sharlayan Bank current | -2000 | Moogle:Garlond Ironworks shares | Buy shares | 200 |

The \(200\) in the last column indicates that the transaction purchased \(200\) shares. Since this column does not exist in the exported postings table, you will need to remember the meaning of this extra column yourself. You can also edit the table header manually and write dst_change in the first line of the last column to clarify the meaning of this column of data. TataruBook doesn’t care about the content of the table header when processing the inserted data.

It is not necessary to provide the real-time transaction price when adding the transaction, as the amount of change for both accounts already reflects the transaction price at that time. If you wish to record the fees/commissions/taxes for a transaction, then you can add the corresponding external account and split a transaction into multiple entries.

After adding this transaction, TataruBook again reports data consistency issues:

Integrity check after insertion.

These (date, asset) pairs need price info in calculation.

(2, 'Garlond Ironworks shares', 1, '2023-12-31')

This is because TataruBook needs to know the value of the other assets measured in home currency when calculating the net worth, so you need to enter the share price on a specific date. We add records to the prices table to fulfill this requirement:

| price_date | asset_index | price |

|---|---|---|

| 2023-12-31 | Garlond Ironworks shares | 12 |

It is now possible to view all records on end_stats view to see all account balances and market values on the end_date:

If you follow this tutorial all along, now there is already an end_stats.csv file existing in this folder because we’ve exported it before. In this circumstance, when you execute TataruBook export view, you will see an error message and that file will not be updated. That’s because TataruBook avoids accidentally damaging existing files. So you need to delete the end_stats.csv file first, and then execute TataruBook export view.

| asset_order | date_val | account_index | account_name | balance | asset_index | asset_name | price | market_value | proportion |

|---|---|---|---|---|---|---|---|---|---|

| 0 | 2023-12-31 | 1 | Sharlayan Bank current | 9700.0 | 1 | Gil | 1.0 | 9700.0 | 0.8065 |

| 0 | 2023-12-31 | 4 | Sharlayan Bank credit card | -73.0 | 1 | Gil | 1.0 | -73.0 | -0.0061 |

| 1 | 2023-12-31 | 9 | Moogle:Garlond Ironworks shares | 200.0 | 2 | Garlond Ironworks shares | 12.0 | 2400.0 | 0.1996 |

Rate of return on investments

In addition to stocks, other assets such as funds, bonds, commodities, and futures are recorded in a similar way. Let’s add a fund asset to asset_types table:

| asset_index | asset_name | asset_order |

|---|---|---|

| Eorzea 100 Index Fund | 1 |

And add the corresponding account to accounts table:

| account_index | account_name | asset_index | is_external |

|---|---|---|---|

| Moogle:Eorzea 100 | Eorzea 100 Index Fund | 0 |

This fund has multiple transactions, both purchases and redemptions, let’s add these transaction records to postings table:

| posting_index | trade_date | src_account | src_change | dst_account | comment | dst_change |

|---|---|---|---|---|---|---|

| 2023/8/2 | Sharlayan Bank current | -3000 | Moogle:Eorzea 100 | Purchase | 1500 | |

| 2023/8/21 | Sharlayan Bank current | -1000 | Moogle:Eorzea 100 | Purchase | 450 | |

| 2023/9/12 | Moogle:Eorzea 100 | -1000 | Sharlayan Bank current | Redemption | 2500 | |

| 2023/9/30 | Sharlayan Bank current | -1200 | Moogle:Eorzea 100 | Purchase | 630 |

The dst_change column has been added to the header row to more clearly illustrate the last field of each row. But actually TataruBook doesn’t care about the contents of the header row, the value of each field should be filled in the required order.

As before, add the price information for the Eorzea 100 Index Fund on the date end_date:

| price_date | asset_index | price |

|---|---|---|

| 2023-12-31 | Eorzea 100 Index Fund | 2.35 |

When finished, view all account balances and market values as of end_date: (if end_stats.csv file already exists, delete it first)

| asset_order | date_val | account_index | account_name | balance | asset_index | asset_name | price | market_value | proportion |

|---|---|---|---|---|---|---|---|---|---|

| 0 | 2023-12-31 | 1 | Sharlayan Bank current | 7000.0 | 1 | Gil | 1.0 | 7000.0 | 0.5368 |

| 0 | 2023-12-31 | 4 | Sharlayan Bank credit card | -73.0 | 1 | Gil | 1.0 | -73.0 | -0.0056 |

| 1 | 2023-12-31 | 9 | Moogle:Garlond Ironworks shares | 200.0 | 2 | Garlond Ironworks shares | 12.0 | 2400.0 | 0.1840 |

| 1 | 2023-12-31 | 10 | Moogle:Eorzea 100 | 1580.0 | 3 | Eorzea 100 Index Fund | 2.35 | 3713.0 | 0.2847 |

In addition to displaying values by account, you can also view the quantity and value of each asset via end_assets view:

| asset_order | date_val | asset_index | asset_name | amount | price | total_value | proportion |

|---|---|---|---|---|---|---|---|

| 0 | 2023-12-31 | 1 | Gil | 6927.0 | 1.0 | 6927.0 | 0.5312 |

| 1 | 2023-12-31 | 2 | Garlond Ironworks shares | 200.0 | 12.0 | 2400.0 | 0.1840 |

| 1 | 2023-12-31 | 3 | Eorzea 100 Index Fund | 1580.0 | 2.35 | 3713.0 | 0.2847 |

While the final value is calculated, the investor is also concerned about the profit or loss of this fund through these buy and sell transactions. The return_on_shares view allows you to see the returns for each account that contains investments (TataruBook treats all assets that aren’t in the home currency as investments):

| asset_order | asset_index | asset_name | account_index | account_name | start_amount | start_value | diff | end_amount | end_value | cash_gained | min_inflow | profit | rate_of_return |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 2 | Garlond Ironworks shares | 9 | Moogle:Garlond Ironworks shares | 0 | 0 | 200.0 | 200.0 | 2400.0 | -2000.0 | 2000.0 | 400.0 | 0.2 |

| 1 | 3 | Eorzea 100 Index Fund | 10 | Moogle:Eorzea 100 | 0 | 0 | 1580.0 | 1580.0 | 3713.0 | -2700.0 | 4000.0 | 1013.0 | 0.25325 |

These figures show that the Moogle:Garlond Ironworks shares account has an investment return of \(400\) Gil, with a rate of return of \(20\%\), and the Moogle:Eorzea 100 account has an investment return of \(1013.0\) Gil, with a rate of return of \(25.325\%\). If you want to know the detailed calculation process, you can refer to minimum initial cash method.

TataruBook will also see the set of all internal accounts as a portfolio and calculate the rate of return for this portfolio as a whole, the results of which are displayed in portfolio_stats view:

| start_value | end_value | net_outflow | interest | net_gain | rate_of_return |

|---|---|---|---|---|---|

| 5000.0 | 13040.0 | -6562.0 | -65.0 | 1478.0 | 0.178 |

These figures show that all internal accounts had a total investment return of \(1478\) Gil over the statistics period, for a rate of return of \(17.8\%\). Note that interest earnings are included in the investment return. For a detailed description on this calculation, see simple Dietz method.

TataruBook is often used to keep track of all of an individual or family’s assets, so the information in portfolio_stats view is important: it shows the net worth at the end of both start_date and end_date, as well as the net income and expenses and investment income between the two dates.

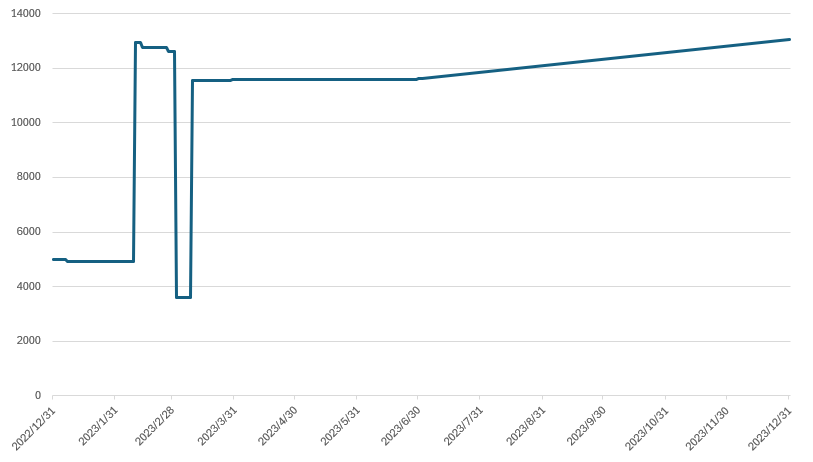

Net worth change chart

Through the net_worth_changes view, you can view the net worth for each day during the period from start_date to end_date. Net worth is the sum of all internal accounts’ balances, i.e., all assets minus all liabilities.

Since the content of this view is quite lengthy, only a portion of the records is listed here for illustrative purposes:

| trade_date | net_worth |

|---|---|

| … | … |

| 2023-01-04 | 5000.0 |

| 2023-01-05 | 4980.0 |

| 2023-01-06 | 4980.0 |

| 2023-01-07 | 4935.0 |

| … | … |

This view shows the net worth for each day prior to 2023-07-02, but starting from 2023-07-03, subsequent dates (except for 2023-12-31) are not displayed in the view. This is because, starting from 2023-07-03, some accounts’ balances include non-standard assets such as stocks and funds, and TataruBook needs to know the prices of these assets to calculate the net worth for that day.

Manually identifying which prices are missing is cumbersome, so the price_unavailable view shows which assets’ prices are missing on which dates:

| trade_date | asset_index | asset_name |

|---|---|---|

| 2023-07-03 | 2 | Garlond Ironworks shares |

| 2023-07-04 | 2 | Garlond Ironworks shares |

| 2023-07-05 | 2 | Garlond Ironworks shares |

| … | … | … |

You can insert some or all of these prices as you need. For example, if you want to know the net worth at the end of 2023-07-03, you can filter the records for 2023-07-03 in the price_unavailable view and insert the prices of these assets on that day into the prices table. After insertion, the net_worth_changes view will include a net worth record for 2023-07-03.

If you want to insert prices for multiple dates in bulk, it is best to use technical means to automatically query and fill in the data. For example, in Excel 365, you can use the STOCKHISTORY function.

The content of the net_worth_changes view can be used to generate a chart showing how net worth changes over time. For example, using Excel’s Charts feature, the line chart generated for the accounting data in this tutorial is:

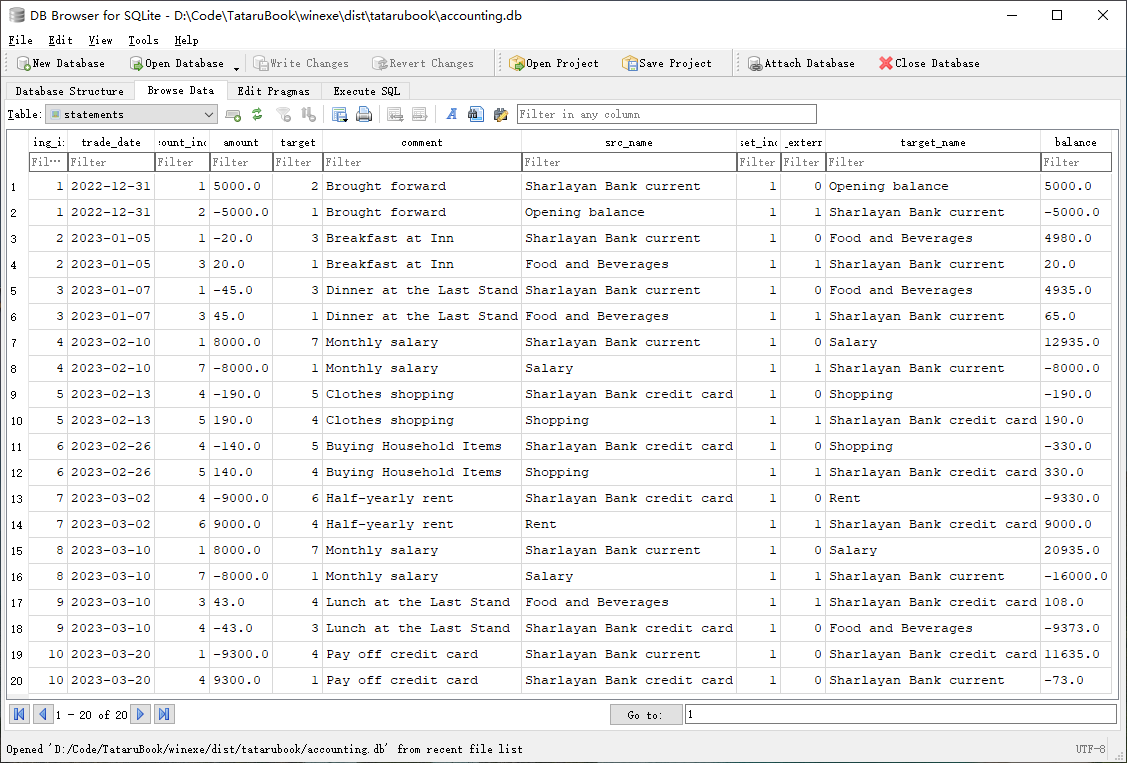

Viewing DB files with GUI software

TataruBook is a command-line program and does not have a graphical interface. However, the DB file containing all the tables and views is a SQLite format file, and any software that supports the SQLite format can view the tables and views in the DB file. Take the open-source software DB Browser for SQLite as an example to demonstrate: first download and install DB Browser for SQLite, then run DB Browser for SQLite, then click the Open Database button and select the accounting.db file to view the data of tables and views in the DB file.

You can also use software other than TataruBook to edit the data in the DB file, but only TataruBook does a perfect consistency check when inserting data. So if you use other software to edit the DB file, it is better to use TataruBook to do the check again. If you know how to use SQL, you can also write your own SQL commands to develop data analysis functions that TataruBook does not provide.