Tables and Views

This page describes all the tables and views contained in the DB file.

Tables contain the financial data provided by the user and they are source of data for all reports. To ensure data integrity and consistency, when adding, modifying, or deleting data from the table, TataruBook checks all aspects to ensure that there are no conflicts or logical contradictions in data.

Views are reports calculated using the data in the tables and contain various statistics such as net worth, categorized income and expenses, and ROI. Whenever the data in any table changes, all views are immediately recalculated and updated. Typically the views are updated so quickly that the user is often unaware of the delay. View updates do not need to be triggered manually.

Some views are user-oriented reports, and some views are intermediate calculations used by other views. Users usually don’t need to pay attention to these intermediate results views. However, if you have doubts about some report data and want to check the calculation process, you can check these intermediate result views. Also, for advanced users who write their own SQL queries, intermediate result views may be useful.

All the views whose names start with check are used to check data consistency. When the data is consistent, these check views should contain no records. If TataruBook finds that the contents of a view beginning with check are not empty, it will report the associated data error on the command-line and prompt the user to fix it.

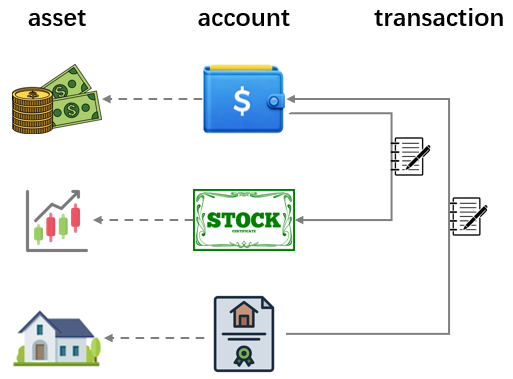

Simplified double-entry bookkeeping

TataruBook follows the “two accounts must be involved in every transaction” requirement of double-entry bookkeeping. However, it does not use the professional accounting method of account categorization and the debit and credit rules for each type of account. Strict adherence to professional accounting methods would make bookkeeping too complex and difficult to understand for the average individual or family. TataruBook therefore uses a simpler and more intuitive method of bookkeeping, dividing all accounts into just two categories:

- Internal account: A positive amount of a change means an increase in asset, a negative amount means an decrease in asset; a positive balance means asset owned, a negative balance means external liabilities.

- external account: A positive amount of a change indicates an expense and a negative amount indicates income or interest.

Thus, the sum of the changes in the two accounts involved in each transaction is always exactly equal to \(0\) (when the two accounts contain the same assets). Adding up the balances of all the internal accounts at any given moment gives you the net worth at that time.

If you have studied professional accounting methods, then be aware that in TataruBook’s simplified double-entry bookkeeping, there are some terms that don’t mean exactly the same thing as the terms used in the professional accounting methods. For example, asset in TataruBook means a currency or a type of tradable ownership with a separate price per unit, NOT liabilites plus equity in the accounting equation.

In the bookkeeping method used by TataruBook, the two accounts involved in each transaction can contain different assets (e.g., two different currencies, or one a currency and the other a stock), such that the amount of change in the two accounts resulting from the transaction no longer adds up to \(0\) (except when the unit prices of the two assets happen to be equal). TataruBook requires that an asset be designated as standard asset (i.e., home currency), and all other assets are converted to standard asset at the corresponding unit price on certain date.

In some views’ names, non-standard assets may be named as shares and standard assets may be named as cash, but note that this is just an analogy for ease of understanding, and does not strictly correspond to shares and cash in reality. For example, if a user defines a standard asset as US dollar, then his Japanese yen cash holdings will be treated as “shares” by TataruBook, because the unit price of Japanese yen fluctuates, and Japanese yen cash holdings may generate gains or losses when valued in US dollar. The amount of asset may not be a whole number, e.g. \(0.1\) or \(0.001\) is allowed for bookkeeping purposes.

Tables

asset_types

A list of assets. In TataruBook, an asset is a type of tradable ownership with separate unit price, such as a currency, a stock, a mutual fund, and so on.

If you use only one currency and do not hold or trade other investments or commodities, then your asset_types table has only one record: the currency you use.

Fields

asset_index(integer): automatically generated index, need not to input.asset_name(string): name of the asset, not allowed to be empty. Used only for display in views, does not affect calculations.asset_order(integer): asset serial number, not allowed to be empty. It is only used for sorting the assets when displayed in views (assets with smaller serial numbers will be listed first), and does not affect calculations. If sorting is not required, you can setasset_orderto \(0\) for all assets.

standard_asset

The standard asset, which is used as the home currency for bookkeeping purposes. All other assets are converted to standard asset to measure the market value.

Fields

asset_index(integer): asset index, not allowed to be empty, must be an index of one of the assets present in the asset_types table.

Constraints

- Only one record is allowed in this table.

- The

asset_indexof any record in the prices table is not allowed to be equal to theasset_indexin this table because the unit price of standard asset is fixed at \(1\). (Checked by check_standard_prices view)

accounts

List of accounts. An account is an entity with separate balance. A person can have multiple accounts in a bank, such as current account, investment account, credit account, etc., so care should be taken when naming accounts.

The unit used for the balance of an account is defined by the asset it contains. For example, if the asset contained in the account is a currency, the account balance is the value in that currency; if the asset contained in the account is a stock, the account balance is the number of shares.

The account balance is not always positive; when the balance is negative, it means that there is a liability in the account. For example, most of the time the balance of a credit card is negative, indicating that the user has a future liability on this account that needs to be returned.

There are two types of accounts: internal accounts and external accounts, see simplified double-entry bookkeeping. An external account represents a class of income/expenses, and the user can customize how the income/expenses are categorized by defining external accounts.

Fields

account_index(integer): automatically generated index, need not to input.account_name(string): account name, not allowed to be empty. Used only for display in views, does not affect calculations.asset_index(integer): index of the assets contained in the account. Not allowed to be empty, must be an index of one of the assets present in the asset_types table.is_external(0or1): a value of0indicates an internal account, a value of1indicates an external account.

interest_accounts

A list of interest accounts. interest accounts are a special class of external accounts that provide interest earnings in transactions such as interests on deposits and financial income.

When a transaction arises between an interest account and an internal account, TataruBook assumes that the internal account generates interest earning and calculates the associated interest rate. For this calculation, TataruBook considers the average daily balance of that internal account to be the denominator of the interest rate. See interest_rates view.

In order not to distort the interest rate data, transactions describing fund/stock distributions should not be related to interest accounts. This is because these distributions are paid in cash to another internal account, not to the internal account in which the fund/share itself resides. To see what way fund/share distributions are recorded, see the example in return_on_shares view.

Fields

account_index(integer): the account index, not allowed to be empty, must be one of the account indexes present in accounts table.

Constraints

- All interest accounts must be external, i.e., the

is_externalfield corresponding to1in accounts table. (checked by check_interest_account view)

postings

List of transactions. According to simplified double-entry bookkeeping, each transaction can be viewed as a transfer of value from one account to another. Thus each transaction record in this list contains a source account and a destination account, and the transaction makes the source account’s balance smaller and the destination account’s balance larger.

As long as the source and destination account contains the same asset, the amount of change in the destination account is equal to the opposite of the amount of change in the source account, i.e., they add up to \(0\). In this case, only the amount of change in the source account needs to be entered and the amount of change in the destination account will be calculated automatically. When the source and destination account contains different assets, it is necessary to use posting_extras table as an aid to record the amount of destination account’s change in this transaction.

Fields

posting_index(integer): automatically generated index, need not to input. Usually, the index of the record entered later is larger than the one entered first.trade_date(string): the date of the transaction, not allowed to be empty, fixed to ISO 8601 format: yyyy-mm-dd. For transactions occurring on the same day, the order is determined according to theposting_index, with smaller indexes coming first, and larger ones coming second.src_account(integer): source account index, not allowed to be empty, must be one of the account indexes present in the accounts table.src_change(float): the amount of change in the source account, not allowed to be empty. The value must be less than or equal to \(0\).dst_account(integer): the destination account index, not allowed to be empty, must be one of the account indexes present in the accounts table.comment(string): transaction comment information, can be empty. Used only for display in views, does not affect calculations.

Constraints

- The value of

src_accountin a record cannot equal the value ofdst_account. (Checked by check_same_account view) - The source and destination account in a record cannot both be external account. (Checked by check_both_external view) (New in v1.1)

- When the source or destination account is an external account in a record, the external account must either contains standard asset or the same asset as another account. (Checked by check_external_asset view) (New in v1.1)

Users who are new to bookkeeping may be wondering how to import the existing balances for each account into a DB file. The recommended approach is to create an external account called Opening balance and for each internal account that needs to have its balance brought forward, add a transaction record transferring value from Opening balance to that internal account.

posting_extras

The amount of change in the destination account when the source and destination account contains different assets. See related description in postings table.

Fields

posting_index(integer): the transaction index, not allowed to be empty, must be one of the indexes present in postings table.dst_change(floating point): the amount of change in the destination account, not allowed to be empty. The value must be greater than or equal to \(0\).

Constraints

- The transaction is not allowed to have any

posting_extrasrecord related when the source and destination account contains the same asset. In this situation, the amount of change in the destination account is equal to the opposite of the amount of change in the source account. (Checked by check_same_asset view) - When the source and destination account contains different assets, the transaction must have a

posting_extrasrecord related to record the amount of change in the specified destination account. (Checked by check_diff_asset view)

prices

The unit price of an asset, used to convert a non-standard asset to the standard asset (home currency) when needed. An asset can have at most one unit price per day, i.e., the unit price of the asset at the end of that day. For assets such as stocks, which have intraday price movements, the asset’s unit price is the closing price of the day. Therefore, if an asset is bought or sold in the transaction for a given day, the actual unit price (real-time price) in that transaction can be unequal to the unit price (closing price) of that asset in the prices table for that day. (See start_stats view for an example)

Fields

price_date(string): date, not allowed to be empty, fixed to ISO 8601 format: yyyy-mm-dd.asset_index(integer): asset index, not allowed to be empty, must be one of the asset indexes present in the asset_types table.price(floating point): the unit price (i.e., \(1\) unit of this asset is equal to how many units of standard asset), not allowed to be empty.

Constraints

- There should be no price records associated with the standard asset. (Checked by check_standard_prices view)

- There should be no more than one price record for one asset on one day, i.e., the

price_dateandasset_indexof any two records cannot both be the same. - On start_date and end_date, all non-standard assets must have a price record associated. (Checked by check_absent_price view)

- If a transaction occurs between two accounts containing the same non-standard asset (or containing different non-standard assets), no matter either account is internal or external, the non-standard asset contained by each account that has an amount of change other than \(0\) in the transaction must have a price record associated on the day of the transaction. For example: if HK dollar is a non-standard asset, then when HK dollar is used to buy a HK stock, the unit price of HK dollar and the unit price of that stock (noting that they are prices measured in the standard asset) must both be present on the day of the transaction. This is because when calculating ROI on these two accounts, they both have an inflow or outflow on the day of the transaction and the value of the inflow/outflow needs to be calculated. (Checked by check_absent_price view)

start_date

The start date of the statistics period, which serves as the starting point of the statistics period for some views. Note that transactions on the start date are not included in the statistics, because statistics period starts at the end of the day of the start date. For example, to statistically analyze financial data for the entire year 2023, the start_date would be 2022-12-31 and the end_date would be 2023-12-31.

Fields

val(string): start date, not allowed to be empty, fixed to ISO 8601 format: yyyy-mm-dd.

Constraints

- Only one record is allowed in this table.

- The start date must be less than the end date.

end_date

The end date of the statistics period, which serves as the ending point of the statistics period for some views. Note that transactions on the end date are included in the statistics. For example, to statistically analyze financial data for the entire year 2023, the start_date would be 2022-12-31 and the end_date would be 2023-12-31.

Fields

val(string): end date, not allowed to be empty, fixed to ISO 8601 format: yyyy-mm-dd.

Constraints

- Only one record is allowed in this table.

- The end date must be greater than the start date.

Views

single_entries

This view serves as an intermediate process for the calculations of the other views, and users usually don’t need to care about this view.

Converts the double-entry transaction records into single-entry. Each record in the postings table becomes two records in this view.

Fields

posting_index:posting_indexfrom postings table.trade_date:trade_datefrom postings table.account_index:src_accountordst_accountfrom postings table.amount: the amount of change in the transaction for this account, fromsrc_change(or its opposite) in the postings table; or fromdst_changein the posting_extras table.target: the account of the other party in the transaction, fromsrc_accountordst_accountin postings table.comment:commentfrom postings table.

statements

Converts the double-entry bookkeeping transaction records into single-entry and displays account information related to each transaction.

Fields

- Contains all fields in single_entries view, as well as:

src_name,target_name:account_namefrom accounts table.asset_index:asset_indexfrom accounts table.is_external:is_externalfrom accounts table.balance: the balance of the account after this transaction (derived from all previous transaction records). For external accounts, the opposite of balance represents the sum of income/expenses for that category.

Example

Assume that the existing table contents are as follows:

asset_types

| asset_index | asset_name | asset_order |

|---|---|---|

| 1 | Gil | 0 |

| 2 | Garlond Ironworks shares | 0 |

standard_asset

| asset_index |

|---|

| 1 |

accounts

| account_index | account_name | asset_index | is_external |

|---|---|---|---|

| 1 | Sharlayan Bank current | 1 | 0 |

| 2 | Moogle:Garlond Ironworks shares | 2 | 0 |

| 3 | Food and Beverages | 1 | 1 |

| 4 | Salary | 1 | 1 |

postings

| posting_index | trade_date | src_account | src_change | dst_account | comments |

|---|---|---|---|---|---|

| 1 | 2023-01-06 | 4 | -50000.0 | 1 | Monthly salary |

| 2 | 2023-01-07 | 1 | -67.5 | 3 | Dinner at the Last Stand |

| 3 | 2023-01-09 | 1 | -13000.0 | 2 | Buy shares |

posting_extras

| posting_index | dst_change |

|---|---|

| 3 | 260.0 |

Then the statements view contents are:

| posting_index | trade_date | account_index | amount | target | comment | src_name | asset_index | is_external | target_name | balance |

|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 2023-01-06 | 1 | 50000.0 | 4 | Monthly salary | Sharlayan Bank current | 1 | 0 | Salary | 50000.0 |

| 1 | 2023-01-06 | 4 | -50000.0 | 1 | Monthly salary | Salary | 1 | 1 | Sharlayan Bank current | -50000.0 |

| 2 | 2023-01-07 | 1 | -67.5 | 3 | Dinner at the Last Stand | Sharlayan Bank current | 1 | 0 | Food and Beverages | 49,932.5 |

| 2 | 2023-01-07 | 3 | 67.5 | 1 | Dinner at the Last Stand | Food and Beverages | 1 | 1 | Sharlayan Bank current | 67.5 |

| 3 | 2023-01-09 | 1 | -13000.0 | 2 | Buy shares | Sharlayan Bank current | 1 | 0 | Moogle:Garlond Ironworks shares | 36932.5 |

| 3 | 2023-01-09 | 2 | 260.0 | 1 | Buy shares | Moogle:Garlond Ironworks shares | 2 | 0 | Sharlayan Bank current | 260.0 |

Note: The statements view is more like the single-entry billing statements that people are usually used to. If you only want to see the movement records for a particular account, you can use other software to open the DB file and filter by account_index or src_name. For example, filtering on a record with account_index of 1 will show all historical transactions and balance changes for Sharlayan Bank current.

start_balance

This view serves as an intermediate process for the calculations of the other views, and users usually don’t need to care about this view.

The balances of all internal accounts which has a balance greater than \(0\) at the end of the day start_date.

Fields

date_val:valfrom start_date table.account_index:account_indexfrom accounts table.account_name:account_namefrom accounts table.balance: the balance of the account obtained by accumulating the amount of change fromstart_dateand all previous transaction records.asset_index:asset_indexfrom accounts table.

start_values

This view serves as an intermediate process for the calculations of the other views, and users usually don’t need to care about this view.

The balances of all internal accounts which has a balance greater than \(0\) at the end of the day start_date, as well as the market values measured in standard asset calculated according to the unit price of the day.

Fields

- Contains all fields from start_balance view, as well as:

price:pricefrom prices table; in the case of the standard asset, the value is \(1\).market_value: the market value calculated by \(\text{price} \times \text{balance}\).

start_stats

At the end of the day start_date, the balances of all internal accounts which has a balance greater than \(0\), as well as the market values measured in standard asset calculated according to each balance multiplied by the unit price of the day, as well as the percentage of each account’s market value to the total value (i.e. the sum of all accounts’ market values).

Fields

- Contains all fields in start_values view, as well as:

asset_order:asset_orderfrom asset_types table.asset_name:asset_namefrom asset_types table.proportion: the proportion of this account’s market value to the sum of all accounts’ market values.

Example

Assume following additional tables are added to existing tables in the example in statements view:

start_date

| val |

|---|

| 2023-1-9 |

prices

| price_date | asset_index | price |

|---|---|---|

| 2023-1-9 | 2 | 51 |

Then the start_stats view contents are:

| asset_order | date_val | account_index | account_name | balance | asset_index | asset_name | price | market_value | proportion |

|---|---|---|---|---|---|---|---|---|---|

| 0 | 2023-01-09 | 1 | Sharlayan Bank current | 36932.5 | 1 | Gil | 1.0 | 36932.5 | 0.7358 |

| 0 | 2023-01-09 | 2 | Moogle:Garlond Ironworks shares | 260.0 | 2 | Garlond Ironworks shares | 51.0 | 13260.0 | 0.2642 |

Note: Note that the values in the balance column are the same as the balances in the statements view for each account on that date; external accounts do not appear in the start_stats view. The purchase of Garlond Ironworks shares is at a unit price of \(13,000 \div 260 = 50\) for the transaction at that time, but the price record (which denotes the closing price) in the prices table on 2023-1-9 is \(51\), and the market value is based on unit price \(51\). This example shows that the real-time trading price can be different from the closing price.

start_assets

At the end of the day start_date, the quantity of each asset, as well as the market value measured in standard asset calculated according to the unit price of the day, as well as the percentage of each asset’s value to the total value.

Fields

asset_order:asset_orderfrom asset_types table.date_val:valfrom start_date table.asset_index:asset_indexfrom asset_types table.asset_name:asset_namefrom asset_types table.amount: the amount of asset calculated by accumulating the balances of all accounts containing this asset.price:pricefrom price table; in the case of the standard asset, the value is \(1\).total_value: the market value calculated by \(\text{price} \times \text{amount}\).proportion: the proportion of the value of this asset to the sum of the values of all assets.

diffs

This view serves as an intermediate process for the calculations of the other views, and users usually don’t need to care about this view.

Statistics on the amount of change per account between start_date and end_date. The transactions on start_date are not counted, transactions on end_date are counted.

Fields

account_index:account_indexfrom accounts table.account_name:account_namefrom accounts table.amount: the amount of change obtained by totaling the amount of change for all transaction records betweenstart_dateandend_date.asset_index:asset_indexfrom the accounts table.

comparison

This view serves as an intermediate process for the calculations of the other views, and users usually don’t need to care about this view.

The balance of each account at the end of start_date and end_date, and the amount of change between the two dates.

Fields

- Contains the

account_index,account_name, andasset_indexfields from diffs view, as well as: start_amount: frombalancein start_balance view.diff:amountfrom diffs view; or \(0\) if the account balance has not changed between the two dates.end_amount: the ending balance calculated by \(\text{start\_amount} + \text{diff}\).

end_values

This view serves as an intermediate process for the calculations of the other views, and users usually don’t need to care about this view.

The balances of all internal accounts which has a balance greater than \(0\) at the end of the day end_date, as well as the market values measured in standard asset calculated according to the unit price of the day.

Fields

- All fields are the same as in start_values view, but the statistics are taken for end_date.

end_stats

At the end of the day end_date, the balances of all internal accounts which has a balance greater than \(0\), as well as the market values measured in standard asset calculated according to the unit price of the day, as well as the percentage of each account’s value to the total value.

Note: The start_date table and the end_date table must each have one record for the end_stats view to display correctly.

Fields

- All fields are the same as in start_stats view, but the statistics are taken for end_date.

Example

Assume following additional tables are added to existing tables in the example in statements view:

start_date

| val |

|---|

| 2023-1-5 |

end_date

| val |

|---|

| 2023-1-9 |

prices

| price_date | asset_index | price |

|---|---|---|

| 2023-1-9 | 2 | 51 |

Then the end_stats view contents are:

| asset_order | date_val | account_index | account_name | balance | asset_index | asset_name | price | market_value | proportion |

|---|---|---|---|---|---|---|---|---|---|

| 0 | 2023-01-09 | 1 | Sharlayan Bank current | 36932.5 | 1 | Gil | 1.0 | 36932.5 | 0.7358 |

| 0 | 2023-01-09 | 2 | Moogle:Garlond Ironworks shares | 260.0 | 2 | Garlond Ironworks Shares | 51.0 | 13260.0 | 0.2642 |

Note: You can see that the content of the end_stats view is almost the same as the start_stats view, with the only difference being that the statistics date is end_date.

end_assets

At the end of the day end_date, the quantity of each asset, as well as the market value measured in standard asset calculated according to the unit price of the day, as well as the percentage of each asset’s value to the total value.

Note: The start_date table and the end_date table must each have one record for the end_assets view to display the correct content.

Fields

- All fields are the same as in start_assets view, but the statistics are taken for end_date.

external_flows

This view serves as an intermediate process for the calculations of the other views, and users usually don’t need to care about this view.

Transactions between start_date and end_date for each external account, and the unit price of the according asset on the day of the transaction. Transactions on the day of start_date are not counted, transactions on the day of end_date are counted. Note that each external account (other than the interest account) represents a specific category of income and expenses.

Although the view name is external flows, unlike the definition of external flows in Rate of Return, this view includes interests.

Fields

trade_date:trade_datefrom postings table.asset_order:asset_orderfrom asset_types table.account_index:account_indexfrom accounts table.account_name:account_namefrom accounts table.amount:amountfrom single_entries view.asset_index:asset_indexfrom accounts table.asset_name:asset_namefrom asset_types table.price:pricefrom price table; value1if standard asset.

income_and_expenses

The total amount of change with transactions between start_date and end_date per each external account, as well as the corresponding market value measured in standard asset. Transactions on the start_date are not counted, transactions on the end_date are counted. Note that external accounts (other than interest accounts) represent specific categories of income and expenses, so this view can be viewed as a categorized count of income, expenses, and interest over the statistics period.

Fields

- Contains

asset_order,account_index,account_name,asset_ index,asset_namefields in external_flows view, as well as: total_amount: the total amount of change (not converted to standard asset) obtained by accumulating the amount of change in all transaction records for this external account betweenstart_dateandend_date.total_value: the total market value obtained by converting the amount of change in each transaction to standard assets at the asset’s unit price of the day and adding it up. Assuming that there are a total of \(n\) transactions in an external account, and the amount of change in each transaction is \(a_1 \dots a_n\) respectively, and the unit price of the asset contained in the account on the day of each transaction is \(p_1 \dots p_n\) respectively, then the total value will be: \(\displaystyle\sum_{i=1}^{n} p_ia_i\).

Example

Assume that the existing table contents are as follows:

asset_types

| asset_index | asset_name | asset_order |

|---|---|---|

| 1 | Gil | 0 |

| 2 | MGP | 0 |

standard_asset

| asset_index |

|---|

| 1 |

accounts

| account_index | account_name | asset_index | is_external | ||

|---|---|---|---|---|---|

| 1 | Sharlayan Bank current | 1 | 0 | ||

| 2 | Manderville Gold Saucer account | 2 | 0 | ||

| 3 | Salary | 1 | 1 | 1 | 1 |

| 4 | MGP spending | 2 | 1 |

postings

| posting_index | trade_date | src_account | src_change | dst_account | comments |

|---|---|---|---|---|---|

| 1 | 2023-02-06 | 3 | -50000.0 | 1 | Monthly salary |

| 2 | 2023-02-07 | 1 | -30000.0 | 2 | Purchase MGP |

| 3 | 2023-02-12 | 2 | -30.0 | 4 | Gaming entertainment |

| 4 | 2023-02-15 | 2 | -100.0 | 4 | Purchase accessories |

posting_extras

| posting_index | dst_change |

|---|---|

| 2 | 300.0 |

prices

| price_date | asset_index | price |

|---|---|---|

| 2023-02-12 | 2 | 90.0 |

| 2023-02-15 | 2 | 110.0 |

Then the content of the income_and_expenses view is:

| asset_order | account_index | account_name | total_amount | asset_index | asset_name | total_value |

|---|---|---|---|---|---|---|

| 0 | 3 | Salary | -50000.0 | 1 | Gil | -50000.0 |

| 0 | 4 | MGP spending | 130.0 | 2 | MGP | 13700.0 |

Note: Note that the amount of change in the external account is equal to the opposite of the amount of change in the internal account, e.g., the Salary account’s total_amount is \(-50000.0\), which means that the internal account has a total of \(50000.0\) in salary income.

If an external account contains the standard asset (such as Gil in the example), the total market value is equal to the amount of the change accrued; however, if an external account contains non-standard asset (such as MGP in the example), each transaction’s amount is converted to the standard asset at the unit price on the day the transaction occurred, and then accumulated. In this example, the total_value of MGP is calculated as \(30 \times 90 + 100 \times 110 = 13700\).

portfolio_stats

There is only one record: consider the set of all internal accounts as a portfolio, showing the portfolio’s net worth at the beginning and ending of the statistics period, as well as total income and expenses, investment profit or loss during the statistics period.

Fields

start_value: market value at the beginning of the statistics period, obtained by accumulatingmarket_valuefrom start_values view.end_value: market value at the ending of the statistics period, obtained by accumulatingmarket_valuefrom end_values view.net_outflow: the value of net outflow during the statistical period, obtained by accumulatingtotal_valuefrom all external accounts other than interest_accounts in income_and_expenses view. Note that interest is not an inflow or outflow. If there is a net inflow during the statistics period, then this value is negative.interest: the total amount of interest earnings incurred during the statistics period, obtained by accumulatingtotal_valuefrom all interest_accounts in income_and_expenses view.net_gain: the total gain (or total loss) generated by the investments during the statistics period, calculated as \(\text{end\_value} + \text{net\_outflow} - \text{start\_value}\). That is, all changes in net worth are considered investment income (or loss) except for changes resulting from income and expenses. Interest earnings are part of investment income.rate_of_return: the rate of return on investments calculated using the simple Dietz method.

flow_stats

The amount of change in all transactions which involves external account between start_date and end_date per each internal account. Transactions on the day of start_date are not counted, transactions on the day of end_date are counted. Note that external accounts (other than interest accounts) represent specific categories of income and expenses, so this view can be viewed as a categorized count of income, expenses, and interest by each internal account separately during the statistics period.

Note that there are two differences between this view compared to income_and_expenses view:

- In

flow_stats, different internal accounts are counted separately, but inincome_and_expensesthe amounts of transactions from different internal accounts and the same external account are added up and combined; flow_statsonly shows statistics that are aggregated by the amount of change in the corresponding asset, butincome_and_expensesalso shows market values converted to standard asset based on the unit price of the asset.

Fields

flow_index: external account index fromaccount_indexin accounts table.flow_name: external account name fromaccount_namein accounts table.account_index: internal account index fromaccount_indexin accounts table.account_name: internal account name fromaccount_namein accounts table.amount: total amount (not converted to standard asset) obtained by accumulating the amount of change in all transaction records betweenstart_dateandend_datefor this internal account and this external account.

Example

Assume that on the base of existing tables in the example in income_and_expenses view, the following additional records are added to these two tables:

accounts

| account_index | account_name | asset_index | is_external |

|---|---|---|---|

| 5 | Sharlayan workplace pension | 1 | 0 |

postings

| posting_index | trade_date | src_account | src_change | dst_account | comment |

|---|---|---|---|---|---|

| 5 | 2023-02-06 | 3 | -10000.0 | 5 | Workplace pension contribution |

Then the flow_stats view contents are:

| flow_index | flow_name | account_index | account_name | amount |

|---|---|---|---|---|

| 3 | Salary | 1 | Sharlayan Bank current | -50000.0 |

| 3 | Salary | 5 | Sharlayan workplace pension | -10000.0 |

| 4 | MGP spending | 2 | Manderville Gold Saucer account | 130.0 |

Note: Salary has separate statistics for the two different internal accounts, compared to the income_and_expenses view which will only show one salary record (all internal accounts totaled together). In addition, MGP spending counts quantities in MGP, not the standard asset Gil.

share_trade_flows

This view serves as an intermediate process for the calculations of the other views, and users usually don’t need to care about this view.

This is a new view added in v1.2.

Transactions between start_date and end_date that involves internal account (indicated by target field) which contains non-standard asset, as well as the amount of change which will be used to calculate the inflow or outflow value in each transaction. The data in this view is used to calculate the ROI on non-standard asset.

Fields

posting_index:posting_indexfrom single_entries view.trade_date:trade_datefrom single_entries view.account_index:account_indexortargetfrom single_entries view: useaccount_indexif theaccount_indexaccount in single_entries view contains standard asset or theamountin single_entries view is not \(0\), otherwise usetarget.cash_asset:The index of asset that theaccount_indexaccount contains, i.e.asset_indexfrom accounts view.amount:amountfrom single_entries view or the negtive number ofdst_changefrom the corresponding record of posting_extras table: useamountif theaccount_indexaccount in single_entries view contains standard asset or theamountin single_entries view is not \(0\), otherwise use the negtive number ofdst_change.target:targetfrom single_entries view.comment:commentfrom single_entries view.account_name:The account name oftarget, i.e.account_namefrom accounts view.asset_index:The index of asset that thetargetaccount contains, i.e.asset_indexfrom accounts view.asset_name:The name of asset that thetargetaccount contains, i.e.asset_namefrom asset_types view.asset_order:The order of asset that thetargetaccount contains, i.e.asset_orderfrom asset_types view.

share_trades

This view serves as an intermediate process for the calculations of the other views, and users usually don’t need to care about this view.

Transactions between start_date and end_date that involves internal account which contains non-standard asset, as well as the market values of the change in these transactions measured in standard asset. The data in this view is used to calculate the ROI on non-standard asset.

If you think of non-standard assets as stocks, then this view can be interpreted as the cost of buying or the income from selling in each stock trade.

Fields

- Contains all the fields in share_trade_flows view, as well as:

cash_flow: the amount of change in the transaction converted to the market value of standard asset at that day’s unit price.

share_stats

This view serves as an intermediate process for the calculations of the other views, and users usually don’t need to care about this view.

The required minimum initial cash between start_date and end_date for each internal account containing non-standard asset if the balance cannot be less than \(0\), as well as the incremental amount of cash (measured in standard asset) obtained by trading and holding the asset in that internal account. See the introduction to the minimum initial cash method to understand the data in this view.

Fields

asset_order:asset_orderfrom asset_types table.asset_index:asset_indexfrom accounts table.asset_name:asset_namefrom asset_types table.account_index:account_indexfrom accounts table.account_name:account_namefrom accounts table.min_inflow: the required minimum initial cash for this account during the statistics period if the balance cannot be less than \(0\).cash_gained: the incremental amount of cash (measured in standard asset) obtained by trading and holding the asset in this account.

return_on_shares

The rate of return on investment for each internal account containing non-standard asset between start_date and end_date, the market value is measured in standard asset. Transactions on the day of start_date are not counted, transactions on the day of end_date are counted. The rate of return is calculated using the minimum initial cash method.

Fields

asset_order:asset_orderfrom asset_types table.asset_index:asset_indexfrom accounts table.asset_name:asset_namefrom asset_types table.account_index:account_indexfrom accounts table.account_name:account_namefrom accounts table.start_amount: the balance at the start of the statistics period. Fromstart_amountin comparison view.start_value: the market value at the start of the statistics period. Frommarket_valuein start_values view, or \(0\) if this account is not present instart_values.diff: amount of change during the statistics period. Fromdiffin comparison view.end_amount: the balance at the end of the statistics period. Fromend_amountin comparison view.end_value: the market value at the end of the statistics period. Frommarket_valuein end_values view, or \(0\) if this account is not present inend_values.cash_gained: realized gain. Fromcash_gainedin share_stats view, or \(0\) (if this account is not present inshare_stats).min_inflow: the required minimum net inflow. Frommin_inflowin share_stats view, or \(0\) (if this account is not present inshare_stats).profit: the profit (or loss) on the investment in this account, calculated as \(\text{cash\_gained} + \text{end\_value} - \text{start\_value}\).rate_of_return: the rate of return on investment in this account, calculated using the minimum initial cash method.

Example 1

Assume that the existing table contents are as follows:

asset_types

| asset_index | asset_name | asset_order |

|---|---|---|

| 1 | Gil | 0 |

| 2 | Garlond Ironworks shares | 0 |

standard_asset

| asset_index |

|---|

| 1 |

accounts

| account_index | account_name | asset_index | is_external |

|---|---|---|---|

| 1 | Sharlayan Bank current | 1 | 0 |

| 2 | Moogle:Garlond Ironworks shares | 2 | 0 |

| 3 | Opening balance in Gil | 1 | 1 |

| 4 | Opening balance in Garlond Ironworks shares | 2 | 1 |

postings

| posting_index | trade_date | src_account | src_change | dst_account | comments |

|---|---|---|---|---|---|

| 1 | 2022-12-31 | 3 | -10000.0 | 1 | Brought forward |

| 2 | 2022-12-31 | 4 | -10.0 | 2 | Brought forward |

| 3 | 2023-02-08 | 1 | -60.0 | 2 | Buy shares |

| 4 | 2023-03-08 | 2 | -6.0 | 1 | Sell shares |

posting_extras

| posting_index | dst_change |

|---|---|

| 3 | 5.0 |

| 4 | 90.0 |

prices

| price_date | asset_index | price |

|---|---|---|

| 2022-12-31 | 2 | 10.0 |

| 2023-06-30 | 2 | 11.0 |

start_date

| val |

|---|

| 2022-12-31 |

end_date

| val |

|---|

| 2023-06-30 |

Then the return_on_shares view contents are:

| asset_order | asset_index | asset_name | account_index | account_name | start_amount | start_value | diff | end_amount | end_value | cash_gained | min_inflow | profit | rate_of_return |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 2 | Garlond Ironworks shares | 2 | Moogle:Garlond Ironworks shares | 10.0 | 100.0 | -1.0 | 9.0 | 99.0 | 30.0 | 60.0 | 29.0 | 0.18125 |

Note: This example is very similar to Example 1 in minimum initial cash method, except that the intervals between inflows and outflows are different, so the resulting rate of return is the same as in that example. Note that the prices table only needs to provide the unit prices at the beginning and end of the statistics period, not the unit price at the time of each transaction, since the transaction itself already reflects the unit price information.

Example 2

Assume that the existing table contents are as follows:

asset_types

| asset_index | asset_name | asset_order |

|---|---|---|

| 1 | Gil | 0 |

| 2 | MGP | 0 |

standard_asset

| asset_index |

|---|

| 1 |

accounts

| account_index | account_name | asset_index | is_external |

|---|---|---|---|

| 1 | Manderville Gold Saucer account | 2 | 0 |

| 2 | Opening balance in MGP | 2 | 1 |

| 3 | Interest in MGP | 2 | 1 |

interest_accounts

| account_index |

|---|

| 3 |

postings

| posting_index | trade_date | src_account | src_change | dst_account | comment |

|---|---|---|---|---|---|

| 1 | 2022-12-31 | 2 | -1000.0 | 1 | Brought forward |

| 2 | 2023-06-21 | 3 | -10.0 | 1 | Interest payment |

prices

| price_date | asset_index | price |

|---|---|---|

| 2022-12-31 | 2 | 10.0 |

| 2023-06-21 | 2 | 11.0 |

| 2023-06-30 | 2 | 12.0 |

start_date

| val |

|---|

| 2022-12-31 |

end_date

| val |

|---|

| 2023-06-30 |

Then the return_on_shares view contents are:

| asset_order | asset_index | asset_name | account_index | account_name | start_amount | start_value | diff | end_amount | end_value | cash_gained | min_inflow | profit | rate_of_return |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 2 | MGP | 1 | Manderville Gold Saucer account | 1000.0 | 10000.0 | 10.0 | 1010.0 | 12120.0 | 0 | 0 | 2120.0 | 0.212 |

Description: MGP is a non-standard asset, and it has interest earned. In this case, the return_on_shares view calculates the overall return including interest earnings. The separate interest earnings can be checked in the interest_rates view. Remember to add interest account to interest_accounts table. In this example, if the record in interest_accounts is missing, things will become very differenet.

interest_stats

This view serves as an intermediate process for the calculations of the other views, and users usually don’t need to care about this view.

The interest earned by each internal account between start_date and end_date.

Fields

account_index:account_indexfrom accounts table.account_name:account_namefrom accounts table.asset_index:asset_indexfrom accounts table.amount: interest earned on this account (not converted to standard asset) during the statistics period.

interest_rates

The interest earned by each internal account between start_date and end_date, as well as the average daily balance, and the interest rate calculated according to the modified Dietz method for each account.

The rate of return shown in this view is only the rate of return on the interest component and does not include the return generated by changes in the price of the asset.

Fields

account_index:account_indexfrom accounts table.account_name:account_namefrom accounts table.asset_index:asset_indexfrom accounts table.avg_balance: the average daily balance (not converted to standard asset) of the account over the statistics period.interest:amountfrom interest_stats view.rate_of_return: the return on investment (i.e., the interest rate) calculated using the modified Dietz method.

Example

Assume that the existing table contents are as follows:

asset_types

| asset_index | asset_name | asset_order |

|---|---|---|

| 1 | Gil | 0 |

standard_asset

| asset_index |

|---|

| 1 |

accounts

| account_index | account_name | asset_index | is_external |

|---|---|---|---|

| 1 | Sharlayan Bank current | 1 | 0 |

| 2 | Salary | 1 | 1 |

| 3 | Spending | 1 | 1 |

| 4 | Gil interest | 1 | 1 |

interest_accounts

| account_index |

|---|

| 4 |

postings

| posting_index | trade_date | src_account | src_change | dst_account | comments |

|---|---|---|---|---|---|

| 1 | 2023-03-31 | 2 | -10000.0 | 1 | Monthly salary |

| 2 | 2023-09-30 | 1 | -10000.0 | 3 | Big-ticket Spending |

| 3 | 2023-12-21 | 4 | -100.0 | 1 | Interest payment |

start_date

| val |

|---|

| 2022-12-31 |

end_date

| val |

|---|

| 2023-12-31 |

Then the interest_rates view contents are:

| account_index | account_name | asset_index | avg_balance | interest | rate_of_return |

|---|---|---|---|---|---|

| 1 | Sharlayan Bank current | 1 | 5016.44 | 100.0 | 0.02 |

Note: See modified Dietz method for interest rate calculation. Note that the interest_rates table calculates rate based on the amounts of the asset unit included in this account and does not convert them to standard asset, so changes in asset’s unit prices are not reflected in the rate. To see the overall rate of return including changes in asset’s unit prices, see return_on_shares view.

periods_cash_flows

Consider the set of all internal accounts as a portfolio and show everyday’s net inflow/outflow value into/from that portfolio between start_date and end_date, only days that the net inflow/outflow value of which is not \(0\) are shown. The flows on the day of start_date are not counted, the flows on the day of end_date are counted. Interest earnings, as investment income, are not counted as inflows/outflows; transactions between external and internal accounts other than interest accounts are counted as inflows/outflows. At the beginning of the cycle, the net worth of the portfolio are treated as a net inflow; at the end of the cycle, the net worth of the portfolio are treated as a net outflow.

This view is the data needed to calculate the internal rate of return (IRR).

Fields

trade_date: the date of the net inflow/outflow.period: the number of days that have elapsed since the start date.cash_flow: the net inflow/outflow on that date, converted to standard asset. Note that according to the definition of internal rate of return (IRR), inflows are negative and outflows are positive, which is different from the usual definition.

daily_assets

This view serves as an intermediate process for the calculations of the other views, and users usually don’t need to care about this view.

This is a new view added in v1.3.

Shows balance of each asset on the end of each date between start_date and end_date (with these two dates also included). Only records with amount not equal to \(0\) are shown.

Fields

trade_date: the date of the balance.asset_index:asset_indexfrom accounts table.amount: the balance of the asset indicated byasset_indexon the end oftrade_date, not converted to standard asset.

price_unavailable

This is a new view added in v1.3.

Shows absent prices of non-standard assets which are needed by the calculation of the net worth on the end of each date between start_date and end_date (with these two dates also included).

Note that unlike views whose names begin with check, the presence of records in price_unavailable does not indicate a data consistency issue. It only indicates that the net worth for the corresponding date cannot be calculated, so these dates will be skipped in the net_worth_changes view. In reality, assets may not always have a meaningful price every day. For example, stocks do not have market prices on non-trading days. Users can decide which dates’ price information to input based on their own needs.

Fields

trade_date: the date on which the price is absent.asset_index: the asset index of asset whose price is absent. i.e.,asset_indexfrom accounts table.asset_name: the asset name of asset whose price is absent. i.e.,asset_namefrom asset_types table.

Example

Assume that the existing table contents are as follows:

asset_types

| asset_index | asset_name | asset_order |

|---|---|---|

| 1 | Gil | 0 |

| 2 | Garlond Ironworks shares | 0 |

| 3 | Eorzea 100 Index Fund | 0 |

standard_asset

| asset_index |

|---|

| 1 |

accounts

| account_index | account_name | asset_index | is_external |

|---|---|---|---|

| 1 | Sharlayan Bank current | 1 | 0 |

| 2 | Moogle:Garlond Ironworks shares | 2 | 0 |

| 3 | Moogle:Eorzea 100 Index Fund | 3 | 0 |

| 4 | Salary | 1 | 1 |

postings

| posting_index | trade_date | src_account | src_change | dst_account | comment |

|---|---|---|---|---|---|

| 1 | 2025-02-18 | 4 | -8000.0 | 1 | Monthly salary |

| 2 | 2025-02-18 | 1 | -4000.0 | 2 | Buy shares |

| 3 | 2025-02-19 | 1 | -4000.0 | 3 | Purchase |

posting_extras

| posting_index | dst_change |

|---|---|

| 2 | 400 |

| 3 | 2000 |

prices

| price_date | asset_index | price |

|---|---|---|

| 2025-02-18 | 2 | 10.0 |

| 2025-02-19 | 2 | 11.0 |

| 2025-02-19 | 3 | 2.0 |

| 2025-02-20 | 3 | 2.1 |

| 2025-02-21 | 2 | 13.0 |

| 2025-02-21 | 3 | 2.2 |

start_date

| val |

|---|

| 2025-02-17 |

end_date

| val |

|---|

| 2025-02-21 |

Then the price_unavailable view contents are:

| trade_date | asset_index | asset_name |

|---|---|---|

| 2025-02-20 | 2 | Garlond Ironworks shares |

Note: From 2025-02-17 to 2025-02-21, with these two dates also included, there are a total of 5 days. The asset status at the end of each day is as follows:

- 2025-02-17: the balances of all accounts containing non-standard assets are \(0\), so no price information is required.

- 2025-02-18: only the price of

Garlond Ironworks sharesis required, which has been provided in thepricestable. - 2025-02-19: the prices of

Garlond Ironworks sharesandEorzea 100 Index Fundare required, both of which have been provided in thepricestable. - 2025-02-20: the prices of

Garlond Ironworks sharesandEorzea 100 Index Fundare required, but thepricestable only provides the price ofEorzea 100 Index Fund, so the price ofGarlond Ironworks sharesis missing. - 2025-02-21: the prices of

Garlond Ironworks sharesandEorzea 100 Index Fundare required, both of which have been provided in thepricestable.

Therefore, price_unavailable displays the only missing price, which is the price of Garlond Ironworks shares on 2025-02-20.

net_worth_changes

This is a new view added in v1.3.

Consider the set of all internal accounts as a portfolio and show the net worth of the portfolio at the end of each day between start_date and end_date (with these two dates also included). The net worth are measured in standard asset.

The net_worth field in this view has the same meaning as the start_value and end_value fields in the portfolio_stats view, but besides start_date and end_date, net_worth_changes view also shows the net worth for each date between these two dates (if it can be calculated successfully).

This view only displays dates for which calculations can be successfully completed. If any required asset’s price is missing when calculating the net worth for a particular date, that date will be skipped. You can find all missing prices via the price_unavailable view.

The data in this view can be used to generate a chart showing changes in net worth over time. For example, you can copy the data into Excel and use Excel’s Charts feature.

Fields

trade_date: the date of the net worth.net_worth: the net worth measured in standard asset on the end oftrade_date.

Example

Assuming that the existing tables’ contents are the same as the example in the price_unavailable view, then the content of the net_worth_changes view is:

| trade_date | net_worth |

|---|---|

| 2025-02-17 | 0.0 |

| 2025-02-18 | 8000.0 |

| 2025-02-19 | 8400.0 |

| 2025-02-21 | 9600.0 |

Note: From 2025-02-17 to 2025-02-21, with these two dates also included, there are a total of 5 days. The asset status at the end of each day is as follows:

- 2025-02-17: all accounts’ balances are \(0\), so the net worth is \(0\).

- 2025-02-18: the balance of

Gilis \(4000\); the balance ofGarlond Ironworks sharesis \(400\) and the price of which is \(10\). Therefore, the net worth is \(4000 + 400 \times 10 = 8000\). - 2025-02-19: the balance of

Garlond Ironworks sharesis \(400\) and the price of which is \(11\); the balance ofEorzea 100 Index Fundis \(2000\) and the price of which is \(2\). Therefore, the net worth is \(400 \times 11 + 2000 \times 2 = 8400\). - 2025-02-20: the balance of

Garlond Ironworks sharesis not \(0\) but no price for this asset on this date can be found in the prices table, so the net worth for this date cannot be calculated and is not shown in the view. This reason can be inspected in the price_unavailable view. - 2025-02-21: the balance of

Garlond Ironworks sharesis \(400\) and the price of which is \(13\); the balance ofEorzea 100 Index Fundis \(2000\) and the price of which is \(2.2\). Therefore, the net worth is \(400 \times 13 + 2000 \times 2.2 = 9600\).

check_standard_prices

Normally this view shows no records. If a record appears, it means that a price record of the standard asset is present in the prices table, violating the constraint.

check_interest_account

Normally this view shows no records. If a record appears, it means that there are interest accounts that are internal accounts, violating the constraint.

check_same_account

Normally this view shows no records. If a record appears, it means that postings table contains records whose src_account and dst_account are the same, violating the constraint.

check_both_external

This is a new view in v1.1.

Normally this view shows no records. If a record appears, it means that postings table contains records whose src_account and dst_account are both external accounts, violating the constraint.

check_diff_asset

Normally this view shows no records. If a record appears, it means that postings table contains records whose source and destination accounts contains different assets, but the posting_extras table has no corresponding records, violating the constraint.

check_same_asset

Normally this view shows no records. If a record appears, it means that postings table contains records whose source and destination accounts contains the same asset, but the posting_extras table has corresponding records, violating the constraint.

check_external_asset

This is a new view added in v1.1.

Normally this view shows no records. If a record appears, it means that there is at least a record in postings table, of which the source or destination account is an external account, and the external account neither contains standard asset nor the same asset as another account, violating the constraint.

check_absent_price

Normally this view shows no records. If a record appears, it means that some unit prices for certain assets that need to be used in prices table on certain dates are missing, violating the constraint.